Get Avast One to help block scams and protect your phone

- Security

- Privacy

- Performance

A cash point rigged with an ATM skimmer can let fraudsters steal your card details and drain your account before you know it. But there are steps you can take to prevent ATM skimming and protect yourself against other threats to your private information. Read on to learn what ATM skimming is, how to spot and avoid it, and how a comprehensive cybersecurity tool like Avast One can keep you safe online.

ATM skimming is a form of financial fraud in which devices called “skimmers” are used to steal credit or debit card information at cash withdrawal terminals. ATM skimmers are designed to look like part of the ATM machine, and they’re attached to ATM card readers to capture payment card details.

This Article Contains:

ATM skimmers may also have hidden cameras installed to record customer PIN codes. Fraudsters use ATM skimming to illegally obtain personal information for profit. Card numbers, CVV codes, expiration dates, and PINs collected by ATM skimmers are sent to remote devices controlled by the criminals, who may use the details to commit identity theft or other scams. Stolen data can also be offered up for sale on the dark web.

Using ATMs that have been compromised by skimming devices poses a serious risk to your financial security, and may enable fraudsters to make fraudulent online payments, or even spoof (clone) your card. That’s why it’s important to stay aware of your surroundings and make sure the ATMs you’re using are safe.

There are several types of card skimming devices in use, each designed for different types of ATM fraud, but all designed to be practically invisible to the untrained and unsuspecting eye.

Here are some of the most common card skimming methods:

Fake credit card readers placed over the card slot to record data from the magnetic stripe.

ATM keypad overlays to capture button presses and PIN codes.

Miniature hidden cameras to record user activity and card details.

Shimmer devices placed within the ATM card reader to swipe data from the card’s chip.

All skimming devices are designed to look like normal parts of an ATM terminal, so it’s very difficult to notice that anything is amiss. But by examining credit card skimming device photos, and familiarizing yourself with the various skimming methods, it is possible to identify skimming equipment.

A credit card skimmer device looks like a typical ATM card reader — at least at first glance. Upon closer inspection, the card reader may look obviously mounted or bulkier than usual.

The cameras used in ATM skimming schemes are extremely small, and usually disguised to blend in with other parts of the machine. But cameras may give off a strange light or be hidden behind an unusual plastic attachment.

Keypad overlays look a lot like regular ATM keypads, but they may stick out from the ATMs surface or be made from a different material than the rest of the machine.

Shimmers are paper-thin devices inserted into ATM card readers. ATM shimmers record the data on the customer’s card chip while the ATM functions normally, which makes them a particularly difficult type of skimming equipment to detect, since they are hidden within the machine itself.

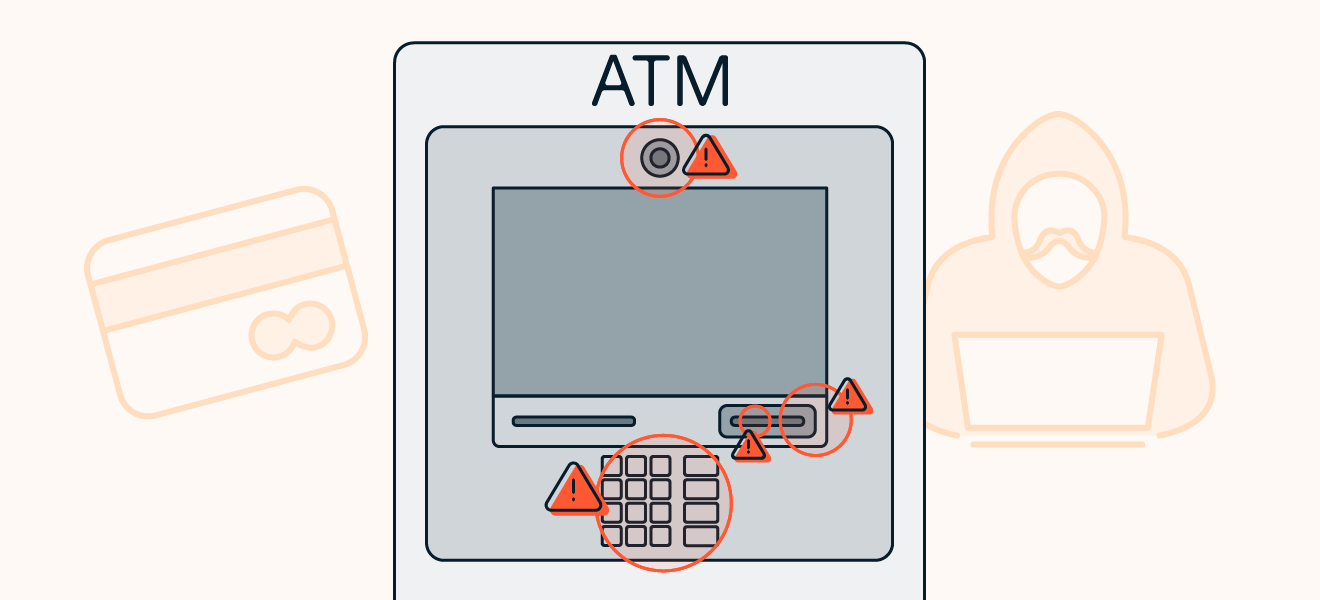

ATM skimming devices like hidden cameras, keypad overlays, and shimmers can capture your card details.

ATM skimming devices like hidden cameras, keypad overlays, and shimmers can capture your card details.

You can tell that an ATM’s been tampered with by noticing subtle but strange abnormalities on the machine’s keypad or card reader. The tell-tale signs of AMT skimmers include the card reader looking too bulky, the PIN pad responding strangely to your touch, or any unusual attachments affixed to other parts of the machine.

Each part of an ATM — including the card reader and keypad — should be fixed firmly in place, with no wiggling or moving parts. ATMs are also constructed with minimal external components, so if you see any extraneous pieces like a plastic bar on the top of the ATM, they may conceal hidden cameras.

If anything looks off at all, inspect the ATM more closely before using it.

You should always check whether an ATM has been fitted with a skimmer before inserting your card or entering your PIN code. Here’s what to look out for when checking for fake ATM card readers:

Traces of glue or other substances around fixtures (the card reader, keypad, etc.)

Loose-fitting or misaligned fixtures

Unusual plastic fittings

Bulkiness on the card reader or keypad

Unusual color-coding on the keypad or keys in an unusual order

Even if everything seems in order, try the following to double-check that the ATM has not been tampered with by a scammer:

Wiggle the card reader slot and try to shift the keypad: ATM skimmers are not firmly fixed in place, so they usually will move when messed with.

Press some keys on the keypad: If the buttons feel sticky, spongy, or too stiff, it may be a false keypad.

Any ATM could potentially be fitted with illegal scanners, even those belonging to banks. But ATMs located on the street with public access are particularly likely targets for skimmers, and some locations are more vulnerable than others. To detect and prevent ATM scams, always keep a sharp eye out for red flags, no matter how secure an ATM may seem.

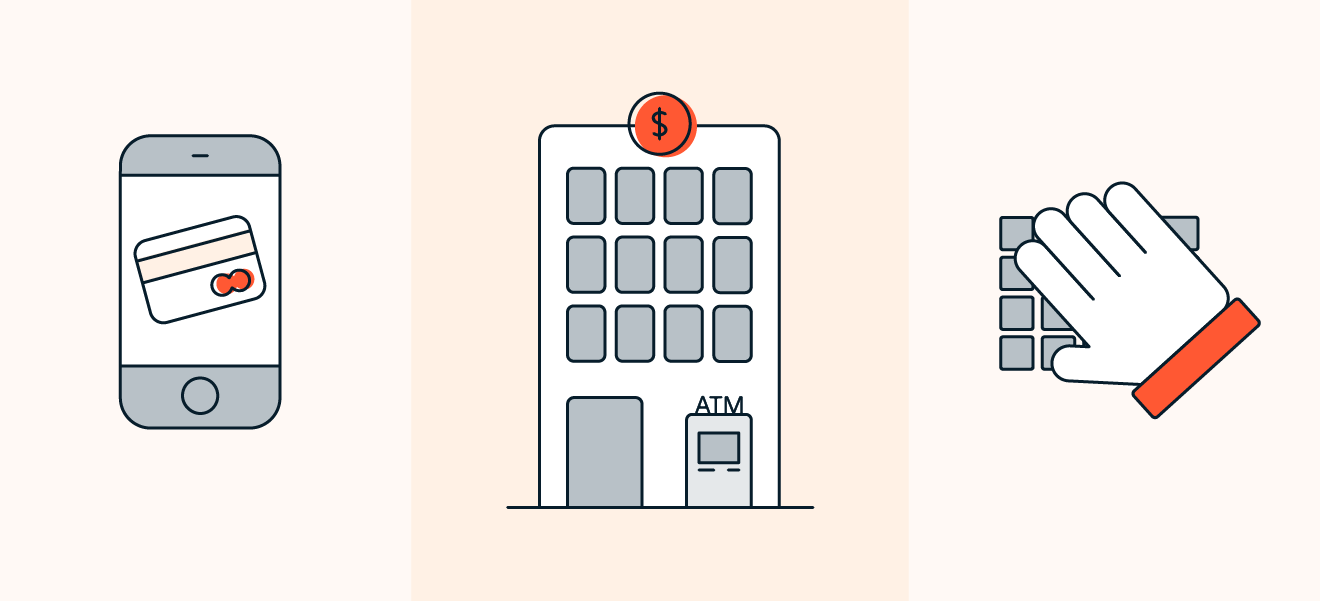

As we move toward an increasingly cashless society, it’s getting easier to avoid ATMs altogether, and thus prevent ATM skimming. Using mobile payment options, such as Google Pay or Apple Pay, not only helps protect against ATM identity theft by letting you bypass fraudsters’ skimming equipment, but also provides an extra layer of security between you and the vendor.

Likewise, paying by card rather than cash reduces the risk of debit card skimming by cutting down visits to the ATM. It’s also safer to make payments via credit card rather than debit card, as this allows you to benefit from enhanced transaction protection.

If you must use an ATM, there are steps you can take to help secure your private information and prevent identity theft. Although no ATM is completely immune to fraudsters installing skimmers, bank ATMs that are located inside banks are much more secure than those outside — especially those on quiet backstreets without much pedestrian traffic.

It’s also good practice to shield your PIN from any hidden cameras by always covering the keypad with one hand when keying in the numbers. But most importantly, if you find signs of tampering, or anything else suspicious about an ATM, don’t use it — report the machine and go find another one.

To protect against ATM skimming, use mobile payments, ATMs inside banks, or cover the keypad when entering your details.

To protect against ATM skimming, use mobile payments, ATMs inside banks, or cover the keypad when entering your details.

If you find a skimmer on an ATM, notify the shop or bank branch immediately so that the ATM can be shut down as soon as possible and additional victims won’t fall for the scam. Any evidence of illegal credit card scanners should also be reported to the police so that they can investigate and take action against the perpetrators.

Checking your bank account regularly will help you detect AMT fraud before too much damage is done. If you find unusual activity such as unknown direct debits, or a fraudulent ATM withdrawal, contact your bank right away so that they can block the skimmed card and stop the fraudster from taking any more of your money.

As with other forms of financial fraud, such as Apple ID phishing scams, you should report the identity theft to the police, and take steps to secure your identity and keep your financial and personal information safe.

Your data is vulnerable to interception, collection, and abuse in all sorts of online and offline scams. That’s why all-encompassing cybersecurity is so important. Avast One is an all-in-one online security solution that combines award-winning anti-malware protection, a VPN for private browsing, and automatic data-breach monitoring to help you react instantly in the event your personal information is ever leaked.

Avast One also features a firewall, blocks dodgy websites and phishing links, prevents webcam hijacking, and even ensures your devices are running optimally. Get comprehensive online security today — completely free.

Download free Avast One to help block online scams and defend your network. Get comprehensive online security.

Install free Avast One to help block online scams and defend your network. Get comprehensive online security.

Download free Avast One to help block online scams and defend your network. Get comprehensive online security.

Install free Avast One to help block online scams and defend your network. Get comprehensive online security.

Get Avast One to help block scams and protect your phone

Get Avast One to help block scams and protect your iPhone